Your Global

Trading Partner

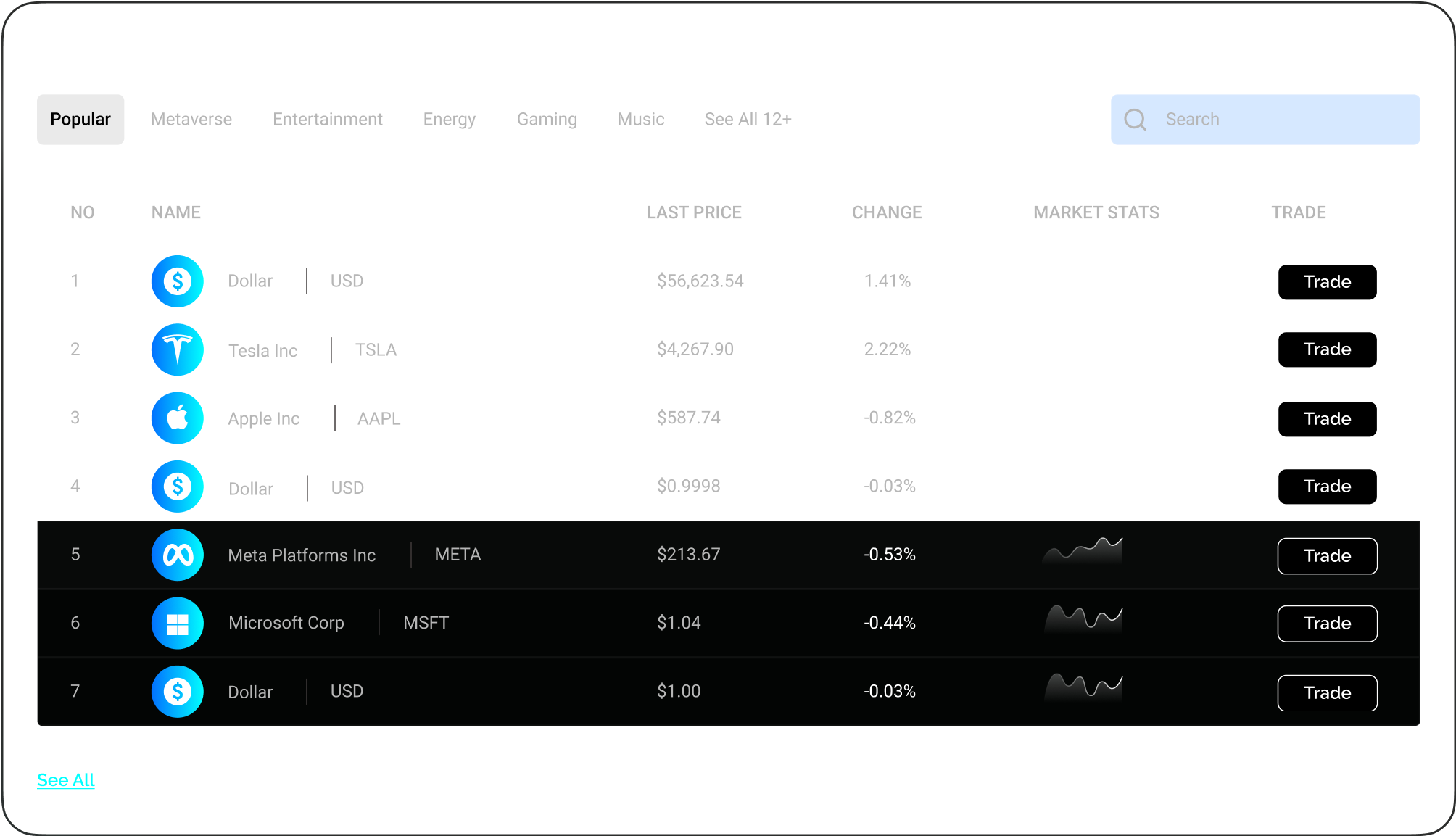

ACG Markets is the go-to trading and analytics platform, offering tight spreads, no hidden fees and unrivalled 24/5 support along with a suite of services and education to help you grow as a trader.

- Trading & Performance Analytics

- Tight spreads

- No hidden Fees, 24/5 Support

- Suite of services to assist our clients growth

At ACG Markets, we’re more than just a fast, trusted and efficient trading platform—we’re your partner in the global financial markets. We’re armed with a community of thousands of traders spanning the globe, there to help and inspire you.

We provide the tools, insights, and 24-hour expert support you need to succeed as a trader. Our user-friendly platform, cutting-edge technology, and expert guidance ensure you can make fast, informed decisions to seize opportunities the moment you spot them.

Simple, safe and smooth…

Investment control at your fingertips.

performance, and optimize your investments.

around the clock

performance

trading to the next level

around the clock

performance

trading to the next level

performance, and optimize your investments.

performance

trading to the next level

performance, and optimize your investments.

around the clock

trading to the next level

performance, and optimize your investments.

around the clock

performance

- Why Work With ACG Markets?

“We’re working toward being the best in the world”

- George Kohler, Founder of ACG Markets

SAFE

Regulated and licensed Broker. So you can sleep easy.

SPECIALIZED

Designed by traders, for traders, making trading effortless.

SUPPORTIVE

24/5 customer support via live chat,

email and discord giving you fast access to help.

SECURE

Your finances and data are encrypted and locked down tight.

SOPHISTICATED

Make life easy and stay ahead of the game with modern trading platforms and tools.

SURCHARGE-FREE

Trade with zero commission and keep hold of more of the profits you earn

- FREQUENTLY ASKED QUESTIONS

Daily loss limit is calculated based on 5% of the starting balance of each trading day. This is the Account balance at the close of the daily candle on broker time.

For example, if the account balance is $100,000 and your equity is $101,000 (at the close of the daily candle), then your max daily risk for the following day will be 5% of the starting balance of the day $100,000 = $5000, and the profits on your P/L carried over from the previous trading day will be added to your daily loss limit. in this case, $5000 + $1000 = $6000.

The daily loss limit for this given day would still be $5000, but you’re allowed to lose $1000 more of the floating profits for a total of $6000.

Daily loss limit is calculated based on 5% of the starting balance of each trading day. This is the Account balance at the close of the daily candle on broker time.

For example, if the account balance is $100,000 and your equity is $101,000 (at the close of the daily candle), then your max daily risk for the following day will be 5% of the starting balance of the day $100,000 = $5000, and the profits on your P/L carried over from the previous trading day will be added to your daily loss limit. in this case, $5000 + $1000 = $6000.

The daily loss limit for this given day would still be $5000, but you’re allowed to lose $1000 more of the floating profits for a total of $6000.

Daily loss limit is calculated based on 5% of the starting balance of each trading day. This is the Account balance at the close of the daily candle on broker time.

For example, if the account balance is $100,000 and your equity is $101,000 (at the close of the daily candle), then your max daily risk for the following day will be 5% of the starting balance of the day $100,000 = $5000, and the profits on your P/L carried over from the previous trading day will be added to your daily loss limit. in this case, $5000 + $1000 = $6000.

The daily loss limit for this given day would still be $5000, but you’re allowed to lose $1000 more of the floating profits for a total of $6000.

Daily loss limit is calculated based on 5% of the starting balance of each trading day. This is the Account balance at the close of the daily candle on broker time.

For example, if the account balance is $100,000 and your equity is $101,000 (at the close of the daily candle), then your max daily risk for the following day will be 5% of the starting balance of the day $100,000 = $5000, and the profits on your P/L carried over from the previous trading day will be added to your daily loss limit. in this case, $5000 + $1000 = $6000.

The daily loss limit for this given day would still be $5000, but you’re allowed to lose $1000 more of the floating profits for a total of $6000.

Daily loss limit is calculated based on 5% of the starting balance of each trading day. This is the Account balance at the close of the daily candle on broker time.

For example, if the account balance is $100,000 and your equity is $101,000 (at the close of the daily candle), then your max daily risk for the following day will be 5% of the starting balance of the day $100,000 = $5000, and the profits on your P/L carried over from the previous trading day will be added to your daily loss limit. in this case, $5000 + $1000 = $6000.

The daily loss limit for this given day would still be $5000, but you’re allowed to lose $1000 more of the floating profits for a total of $6000.

Daily loss limit is calculated based on 5% of the starting balance of each trading day. This is the Account balance at the close of the daily candle on broker time.

For example, if the account balance is $100,000 and your equity is $101,000 (at the close of the daily candle), then your max daily risk for the following day will be 5% of the starting balance of the day $100,000 = $5000, and the profits on your P/L carried over from the previous trading day will be added to your daily loss limit. in this case, $5000 + $1000 = $6000.

The daily loss limit for this given day would still be $5000, but you’re allowed to lose $1000 more of the floating profits for a total of $6000.

Daily loss limit is calculated based on 5% of the starting balance of each trading day. This is the Account balance at the close of the daily candle on broker time.

For example, if the account balance is $100,000 and your equity is $101,000 (at the close of the daily candle), then your max daily risk for the following day will be 5% of the starting balance of the day $100,000 = $5000, and the profits on your P/L carried over from the previous trading day will be added to your daily loss limit. in this case, $5000 + $1000 = $6000.

The daily loss limit for this given day would still be $5000, but you’re allowed to lose $1000 more of the floating profits for a total of $6000.

Daily loss limit is calculated based on 5% of the starting balance of each trading day. This is the Account balance at the close of the daily candle on broker time.

For example, if the account balance is $100,000 and your equity is $101,000 (at the close of the daily candle), then your max daily risk for the following day will be 5% of the starting balance of the day $100,000 = $5000, and the profits on your P/L carried over from the previous trading day will be added to your daily loss limit. in this case, $5000 + $1000 = $6000.

The daily loss limit for this given day would still be $5000, but you’re allowed to lose $1000 more of the floating profits for a total of $6000.

Daily loss limit is calculated based on 5% of the starting balance of each trading day. This is the Account balance at the close of the daily candle on broker time.

For example, if the account balance is $100,000 and your equity is $101,000 (at the close of the daily candle), then your max daily risk for the following day will be 5% of the starting balance of the day $100,000 = $5000, and the profits on your P/L carried over from the previous trading day will be added to your daily loss limit. in this case, $5000 + $1000 = $6000.

The daily loss limit for this given day would still be $5000, but you’re allowed to lose $1000 more of the floating profits for a total of $6000.

- JOIN OUR NEWSLETTER

FREE TRADING ADVICE IN YOUR INBOX

Every week we send out ‘Top Trades’, our weekly email that’ll help you become a smarter trader.

Pop your email in the box and we promise to only send you information to level up your trading skills.

- JOIN OUR NEWSLETTER

FREE TRADING ADVICE IN YOUR INBOX

Every week we send out ‘Top Trades’, our weekly email that’ll help you become a smarter trader. Pop your email in the box and we promise to only send you information to level up your trading skills.